Insurance is one of those expenses we all must pay that can become cumbersome as premiums creep higher and higher each year. Starting from home and auto to life and medical insurance, these premiums mount quickly. However, there are some smart adjustments you can make to decrease your insurance premiums and save in the United States without giving up your protection. Here, we discuss tried-and-true tips and real-world advice to help you maximize your insurance coverage, bundle insurance policies for savings and create household budget to lower premiums.

Managing your insurance expenses starts with honesty. Understanding what you're paying, why you're paying, and how to save money is the start of empowerment. Let's run through the greatest and most achievable budgeting methods for reducing your insurance expenses and saving money in the U.S.

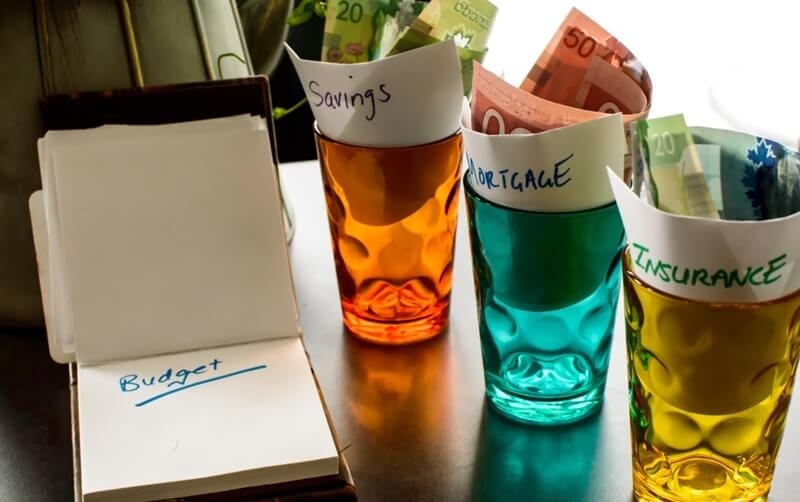

A good household budget is the foundation of all sound financial decisions. In the U.S., to save money and reduce insurance premiums, you must begin by establishing a household budget to reduce premiums. Tracking your income, expenditures, and current insurance costs will reveal trends and areas for expenditure reduction.

This cap enables you to check whether you're over-insured or have extras you don't need. It also gives you leverage when you go shopping for better plans, negotiate with vendors, or choose deductible levels within your income range.

One of the oldest insurance book stunts still works as well as ever. Grouping insurance policies together to save is a great way to reduce insurance premiums.

Choosing the right deductible is another strategic move to reduce your insurance expense and save money in America. A deductible is an amount of money you agree to pay upfront before your policy begins. The higher your deductible, the lower your monthly or annual premium.

Implementing a deductible strategy for saving money means establishing your risk tolerance and financial readiness. If you infrequently file claims and possess an emergency fund, choosing a higher deductible could reduce your premium considerably. For example, increasing the deductible on your auto coverage from $250 to $1000 could decrease your premium by as much as 30%.

But this works only if you're prepared to pay the deductible in the event of a claim. A deductible strategy for savings is all about weighing the probability of risk against the guarantee of frequent savings. It's a conscious trade-off, but for most households, it can free money that can be reallocated elsewhere in the budget.

Loyalty to a single insurance provider can appear to be the conservative approach, but it typically has a cost. Premiums increase over time without reason. To shop annually for better rates U.S is one of the best things to do.

This plan helps achieve your objective of lowering insurance premiums and saving money in America without compromising the quality of coverage. Used in conjunction with other strategies such as bundling or employing a deductible plan to save, the amount of possible savings can be substantial.

Few people know that a credit score directly affects insurance premium costs. For the most part, in most U.S. states, insurers determine the likelihood of a policyholder filing a claim by using a credit-based insurance score. That is why it is important to maintain credit in good standing to maintain low premium costs across various insurance products.

This includes paying your bills on time, maintaining a low credit utilization ratio, and disputing any inaccuracies on your credit reports. Being smart with your credit not only qualifies you to borrow more but also makes you a more attractive prospect to insurance companies.

Maintaining good credit to lower premium rates isn't done overnight, but it's something that pay dividends slowly but surely over the long haul—making it one of the most underutilized cut insurance premiums saving tips available to consumers.

It's easy to assume what's really covered under your insurance policy. You may accumulate coverage options over time that no longer coincide with your lifestyle or value of your property. Checking your policy every year and cancelling the unnecessary coverage is another wise move to reduce insurance premiums and save money in America.

For example, if your car is more than 10 years old, comprehensive and collision coverage will not be worth it. Or when you've already paid off your house, you can cut some of the add-ons on your home insurance. Every item you cut with careful consideration can help reduce your premium.

This is best done when you create household budget to lower premiums as this allows you to bring the cost of keeping coverage into perspective against potential savings. Trim the unnecessary and you keep from overpaying and keep your policies in proportion with your actual exposure.

Most insurance companies carry a multitude of discounts not well known. Some of these discounts are good driver discounts, safe homeowner discounts, paperless bill discounts, and even a discount for completing a defensive driving course. One of the easiest reduce insurance premiums saving tips to adhere to is simply asking your company directly.

If you’ve been with the same company for a few years, inquire about loyalty discounts. Some companies have tiered systems where longer relationships lead to lower premiums or better coverage options. These benefits may not be automatic—you must ask.

You can also get discounts based on your profession. Educators, the armed forces, firefighters, and medical professionals typically get lower rates. You can save in America with little effort by taking initiative and asking the proper questions to reduce insurance premiums.

Insurance is based on risk. The more you have, the more you pay. By increasing safety devices in your home or vehicle, you can potentially unlock reductions and long-term savings. That may include fitting security systems, smoke detectors, dashcams, or theft-deterrent units.

These changes specifically lower the risk of loss or damage and tell the insurer that you're taking steps to minimize claims. Consequently, most insurers will pay back lower premiums. If you're attempting to create a household budget to lower premiums, this is one of the better investments you can make.

Besides, maintaining a clean driving record, taking safety courses, and refraining from filing small claims can keep your risk level low and premiums even lower. These actions supplement other measures such as the use of a deductible savings strategy and bundling of insurance policies for discounts.

The road to financial independence is paved with little, careful steps—and insurance premiums are just one area where smart choices reap long-term rewards. Whether you opt to create a household budget to lower premiums, bundle insurance policies for a discount, use a deductible plan to save, or shop annually for better rates U.S, the bottom line is the same: more money in your pocket without compromising peace of mind.

Maintaining good credit to lower premium costs, excluding coverage that's unnecessary, and increasing safety in and around the home and vehicle are insurance-savings tools in your toolshed as well. Consistency is the ticket. They're not solutions that have a fast impact—they're long-term habits that align your insurance expenditures with your goals.

By following these reduce insurance premiums saving tips and making informed adjustments over time, you’ll build a more resilient budget and a more secure future for yourself and your family.

This content was created by AI