Applying HSA to save on medical care can be an intelligent, strategic method of reducing healthcare costs and accumulating long-term savings. Health Savings Accounts (HSAs) provide a special tax-advantaged method of controlling insurance premiums and healthcare costs. In this manual, we will demystify how HSAs function, learn about HSA eligible expenses explained U.S., and illustrate how maximizing your contributions to HSAs on an annual basis and combining your HSA with a High Deductible Health Plan (HDHP) can be extremely financially advantageous. We will also delve into the tax advantages of HSA accounts and how to make HSA money work for you in the long term as a valuable instrument in your financial plan.

A Health Savings Account (HSA) is a tax-favored savings account that can assist individuals with high-deductible health Plans (HDHPs) in covering qualified medical expenses. HSAs provide triple tax benefits:

This triple play makes utilizing HSA to save on healthcare an extremely potent tactic.

To open and make contributions to an HSA, you need to satisfy the following requirements:

There are several reasons that people and families select to use an HSA to save on healthcare:

You must know what you can spend your HSA money on. HSA eligible expenses explained U.S. are defined by the IRS and are:

Keep all receipts and documentation for IRS reporting and future audits. Using your HSA for ineligible expenses before age 65 will incur a 20% penalty plus income tax.

Contributing the maximum allowable amount each year is key to getting the most from your HSA. The IRS sets annual contribution limits, which are adjusted for inflation.

2025 Contribution Limits:

Tips for maximizing HSA contributions each year:

Maximizing HSA contributions each year ensures you save enough for short-term and long-term healthcare expenses.

It must be paired with a High Deductible Health Plan (HDHP). This combination with the HDHP's low cost is how the HSA offers tax advantages and lower premium payments.

Advantages of this combination are:

Ensure your HDHP has IRS minimum deductibles and maximum out-of-pocket limits to be HSA-eligible.

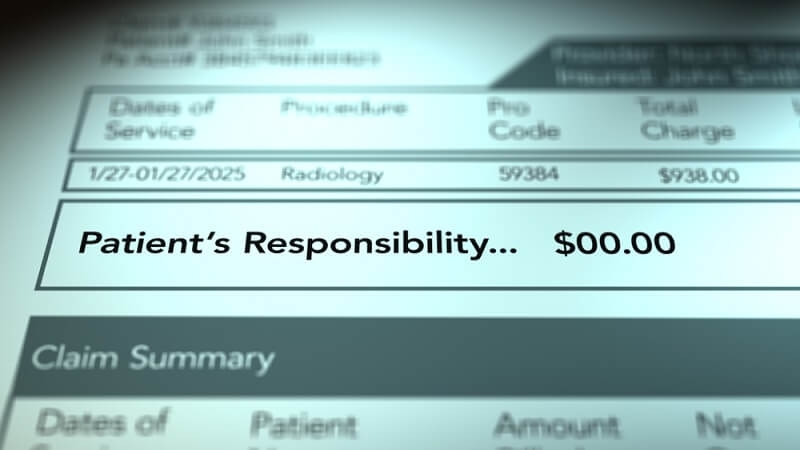

One of the biggest advantages is the tax advantages of HSA accounts, also known as the "triple tax advantage":

Generally, HSA contributions are excluded from state income taxes in most states, so it makes it even more appealing.

Most people are using HSA money for their healthcare needs encompassing their current healthcare costs, but an alternative smart strategy would be to be long-term investors of your HSA funds for future healthcare or retirement needs.

Why invest HSA money?

Investing HSA funds long term best practices:

This strategy makes your HSA a hybrid of a retirement account and a health expense fund.

Scenario 1: Young Professional

Emily is 29 years old, healthy, and only goes to the doctor sometimes. She selects an HDHP and contributes the most to her HSA. She pays out-of-pocket for small costs and invests the rest. Her HSA has grown a lot in 10 years with compound interest.

Scenario 2: Growing Family

Tom and Lisa have two kids and a predictable range of annual medical costs. They use their HSA for expenses like pediatric visits and prescriptions while contributing annually. The tax savings and rollover benefits help manage their growing healthcare costs.

Steering clear of these pitfalls will enable you to get the most out of using HSA to cut costs on healthcare.

Feature HSA FSA

HSAs have more convenience and long-term value, particularly when combined with an HDHP low-cost strategy.

When choosing an HSA provider, look for:

The correct provider can make it simple and more convenient to manage your HSA.

At 65, you can take HSA money out for any reason without penalty—though non-medical withdrawals will be taxed as ordinary income. This makes an HSA equivalent to a traditional IRA but with greater flexibility.

Tip: Keep maxing out HSA contributions every year until age 65 to utilize the account for:

The IRS could request documentation for tax purposes, particularly if you are audited.

One of the best ways to utilize an HSA is by treating it as a long-term safety net for your healthcare costs. Instead of paying for your medical costs out-of-pocket and letting the HSA bill you, think about utilizing your out-of-pocket expenses as much as you can each year. If your HSA charges money, pay it out-of-pocket and let your HSA, treated as an HSA, tax-free, grow. Over the long term, the investment outcome of HSA money is significant, compounding, and each income/result is considerable. In effect, you can utilize your HSA later in life as health expenses are typically larger.

By maximizing contributions each year and utilizing the advantages of HSA accounts and tax reductions, you can reduce the need for sudden financial planning around a medical event, and the stress it creates, when you have a sizable account to draw from. Also, the funds in your HSA never expire and roll over year after year, and can be used as a supplemental retirement asset when you ultimately retire and use less health and are on a blank check retirement! If you plan and use an HSA in this way, you can be empowered to protect both yourself and your family from sudden/unforeseen medical costs and build long-term wealth.

Using HSA to save on healthcare is one of the most effective ways to manage out-of-pocket expenses, lower insurance costs, and even invest for the future. By understanding HSA-eligible expenses in the U.S., maximizing HSA contributions annually, and pairing with an HDHP low-cost strategy, you’ll gain control over your healthcare finances. Additionally, the tax benefits of HSA accounts, coupled with possible long-term investing of HSA funds, make it a no-brainer for smart and careful planners.

This content was created by AI